JUST LANDING?

HOW TO CALCULATE YOUR SPANISH PERSONAL INCOME TAX… AND WHY YOU NEED TO READ THIS IF YOU PLAN TO MAKE OVER 55 000€ OF ANNUAL INCOME IN SPAIN

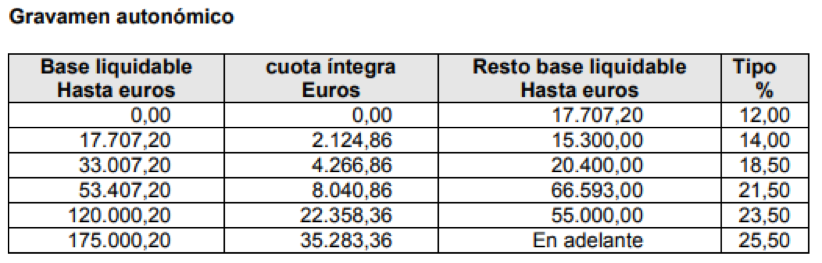

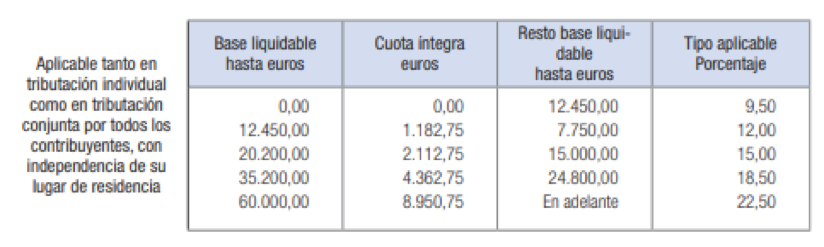

In Spain, half of your tax goes to the central state, the other half to the autonomous region. In this example, we’ll consider that you’ve just landed in Catalonia. Here is the kind of information you’ll find on official websites:

2017 rate :

The first column is the taxable income, the last one the rate. The rate (tipo) apply to each bracket: In Catalonia, in the first one up to 17 707, 20€ of taxable income, your tax rate is 12%. From +17 707,20 to 33 007,20 your tax rate is 14 %, etc.

Note that you need to calculate this twice with the Central State and autonomous region rate and sum them up. (the actual maximum rate is 25,5+22,50 = 48%)

Let’s take an example for a gross salary of 40.000€:

You will support around 2.540€ of social insurance contribution which are deductible plus a general deduction of 2.000 additional euros.

The taxable net income will then be 35.460€

Over this you need to apply the tax rate table

The calculation will then be – estimation done over 2017 rates – :

| 17.707,20 | 12% | 2.124,86 | |

| 15.300,00 | 14% | 2.142,00 | |

| 2.452,80 | 18,5% | 453,77 | |

| 4.720,63 | Autonomica | ||

| 12.450,00 | 9,5% | 1.182,75 | |

| 7.750,00 | 12% | 930,00 | |

| 15.000,00 | 15% | 2.250,00 | |

| 260,00 | 18,5 | 48,10 | |

| 4.410,85 | Estatal | ||

| Deduction of 5.500 for young person without children | |||

| 5500 | 12 | 660 | |

| 5500 | 9,5 | 522,5 | |

| 4.720,63 | Autonomica | ||

| -660,00 | |||

| 4.060,63 | |||

| 4.410,85 | Estatal | ||

| -522,50 | |||

| 3.888,35 | |||

| TOTAL TAX | 7.948,98 | ||

| TAXABLE Income | 35.460,00 | ||

| % taxes | 22,4167569 |

The result is 22,41% of your taxable income, or 19,87% of your 40 000€ gross annual income.

At 45.000€ gross the taxable income would be of 40.143€ and you would pay 9.671€ so 24% over the taxable income and 21,50% over the gross.

At 55000€ gross with a taxable of 50.143 then the rates would be of 24,30% and 26,66% and you’ll pay 13.371€ of tax.

When your tax rate is over 24% of your gross annual income, you might consider to apply for a special tax regime, called “Beckham regime”, a special tax treatment meant originally for football players coming to Spain for a few years.

In this regime, a 24% flat rate applies the first year you qualify as a tax resident and the five following years.

During this period, you are not considered a Spanish tax resident and therefore don’t have to file the foreign asset declaration (see: modelo 720).

Note that under this special regime, only your Spanish income is taxable, unlike the normal regime (tax resident) where your worldwide assets and income should be declared.